Nonprofit Revenue Recognition: What It Is & Why It Matters

Grant Revenue Recognition 101

Understanding GAAP for Nonprofit Organizations and Revenue Recognition

Generally Accepted Accounting Principles (GAAP) concerning revenue recognition have created much confusion and consternation in the non-profit arena. GAAP requires companies to recognize revenue when they realize and earn it, not when they receive cash. This means that organizations that receive multi-year grants that are classified as contributions must recognize all the revenue from the grant in the year the grant was given.

Key Reasons for Changes in Nonprofit Revenue Recognition

The new revenue recognition rules were created for several reasons:

- Removal of inconsistencies and weaknesses in existing revenue requirements.

- Providing a more robust framework for addressing revenue issues.

- Improvement of comparability of revenue recognition practices across entities, industries, jurisdictions and capital markets.

- Providing more useful information to users of financial statements through improved disclosure requirements.

- Simplifying the preparation of financial statements by reducing the number of requirements to which an organization must refer.

Contributions vs. Exchanges: How to Classify Your Grants

Each organization must review their grant agreements and other funding arrangements and determine whether they are contributions or exchanges. An exchange is a reciprocal transaction where both parties give and receive something of equal value, i.e., services for compensation. A contribution is a non-reciprocal transfer where a party gives something without expecting anything in return.

5 Essential Steps for Recognizing Nonprofit Revenue

Organization should establish the following five steps when new funding occurs:

- Identify the contract with the customer.

- Identify if there are performance obligations (promises) in the contract.

- Determine the value of the contract.

- Allocate the transaction value to the performance obligations.

- Recognize revenue based on the nature of the contract.

How Multi-Year Grants Impact Financial Statements

This GAAP rule causes all the revenue from multi-year grants, deemed to be contributions, to be recorded in the year the grant is executed. This sometimes causes confusion with management and boards because in the out years of these grants, losses are produced, when, in fact, there is revenue to cover those expenses.

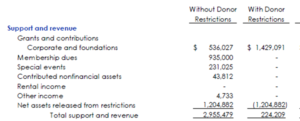

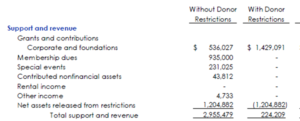

Net Asset Accounting and Donor-Restricted Funds

This process happens in the organization’s net asset accounting. It involves releasing donor-restricted funds on their statement of activities.

Why Nonprofits Should Adjust Their Financial Statements

Organizations should think about changing their internal financial statements. They should record these releases from Donor Restricted Funds when they issue their statements.

For example, if an organization receives a $2.5M grant to use over five years, the organization will receive the funds in equal parts each year. The revenue recognition rules require the company to count the entire $2.5M as revenue in the first year. The organization’s financial statements will show a large increase in net assets in the first year because of this treatment.

In the next four years, the organization will likely show losses on this grant. This is because the grant expenses will be around $500,000. All the revenue was recorded in the first year. The organization will still get the $500,000 payments in cash on the anniversary dates. This money will cover the actual costs of the grant for that year.

Common Misconceptions in Nonprofit Grant Accounting

Organizations should be careful of incorrect information existing in the marketplace. For example, ChatGPT says you should record grants as deferred revenue. Then, you recognize revenue each year as you receive cash. Obviously, this is not the correct method for recording a grant that is a contribution.

Best Practices for Compliance with Nonprofit Revenue Recognition Standards

Organizations should also consult with their finance departments and/or their external auditors as grants and funding agreements are received to ensure that the correct accounting standards are applied to each transaction. Discover all the ways we support back office operations for non-profits.